philadelphia transfer tax exemption

Pa Commonwealth Court Order No. Get Real Estate Tax relief.

Philadelphia Deed Transfer Form Fill Out And Sign Printable Pdf Template Signnow

Get a property tax abatement.

. Active Duty Tax Credit. Get a property tax abatement. Hosts public meetings about historic properties.

Report a change to lot lines for your property taxes. The Philadelphia Department of Public Health is sending texts and emails to contact individuals who have recently been tested for COVID-19. Get the Homestead Exemption.

Enroll in the Real Estate Tax deferral program. Get a property tax abatement. Look up your property tax balance.

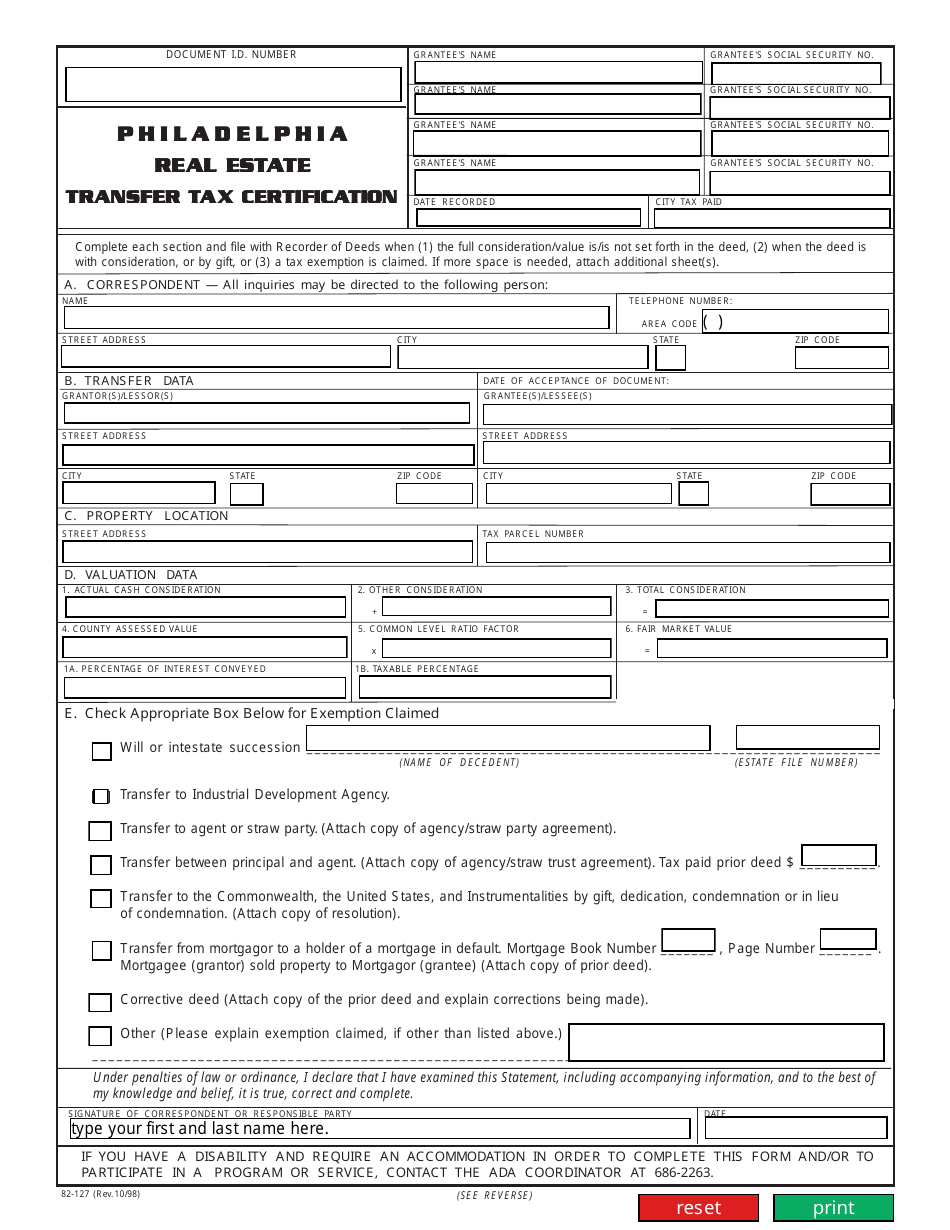

You can also use our online refund forms for faster and more secure processing. PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Complete each section and fi le in duplicate with Recorder of Deeds when 1 the full considerationvalue isis not set forth in the deed 2 when the deed is with consideration or by gift or 3 a tax exemption is claimed. Owners who disagree with the OPA can file an appeal with the BRT.

Report a change to lot lines for your property taxes. Get the Homestead Exemption. Works with property owners to.

Under the Real Estate Tax freeze the amount of property tax you pay each year will not increase even if. Report a change to lot lines for your property taxes. Get the Homestead Exemption.

Report a change to lot lines for your property taxes. The tax clearance section of the Philadelphia Tax Center. Effective January 1 2014 all employee Wage Tax refund petitions require documentation to verify any time worked outside of Philadelphia.

Get the Homestead Exemption. 2021 Accessibility Provisions rescinded. Taxpayers have until May 17 2021 to file and pay Business Income and Receipts Tax Net.

Get a real estate tax adjustment after a catastrophic loss. Set up a Real Estate Tax installment plan. 2021 has permanently enjoined.

Get the Homestead Exemption. Look up your property tax balance. You can also apply for credits online through the Philadelphia Tax Center.

Set up a Real Estate Tax installment plan. This certificate is required in order to obtain some permits and licenses. Set up a Real Estate Tax installment plan.

Enroll in the Real Estate Tax deferral program. The Disabled Veterans Tax Exemption provides real estate tax exemption for any honorably discharged veteran who is 100 disabled is a resident of the Commonwealth of Pennsylvania and has a financial need. Set up a Real Estate Tax installment plan.

Identifies and designates historic landmarks. You dont need to create. Enroll in the Real Estate Tax deferral program.

Get Real Estate Tax relief. Get breaking Finance news and the latest business articles from AOL. Enroll in the Real Estate Tax deferral program.

Get a property tax abatement. Active Duty Tax Credit. Report a change to lot lines for your property taxes.

Get a nonprofit real estate tax exemption. The tax becomes payable when a property deed or other document showing realty ownership is filed with the Records Department. Report a change to lot lines for your property taxes.

Get Real Estate Tax relief. Only non-resident employees are eligible for a refund based on work performed outside of. Deed transfers and entity transfers have their own unique forms.

Effective immediately Code Bulletin B-2101- Implementation of 2021 International Code Accessibility Provisions is rescinded and the City of Philadelphia will revert back to the accessibility provisions contained in the 2018 International Codes. Report a change to lot lines for your property taxes. Set up a Real Estate Tax installment plan.

Report a change to lot lines for your property taxes. Look up your property tax balance. A tax clearance certificate shows that your tax account is in good standing with the City of Philadelphia.

The Philadelphia Department of Revenue will prevent your Real Estate Tax bill from increasing if you meet certain age and income requirements. From stock market news to jobs and real estate it can all be found here. As part of the Department of Planning and Development the Philadelphia Historical Commission protects the Citys historic resourcesTogether with its advisory committees the commission.

Documents showing ownership include. Generally spouses who are both US citizens may transfer unlimited amounts to each other without incurring any gift tax as any assets in excess of the couples combined estate tax exemption 2412 million in 2022 will be taxed at the death of the surviving spouse and transferring assets to the survivor only defers the tax that the IRS will. Look up your property tax balance.

Technical private letter rulings. Get a nonprofit real estate tax exemption. Individuals are asked to complete a brief survey to help the Philadelphia Department of Public Health better understand and.

Enroll in the Real Estate Tax deferral program. Any claim for refund must be filed within three years from the date the tax was paid or due whichever date is later. Get a real estate tax adjustment after a catastrophic loss.

The Board of Revision of Taxes BRT hears property assessment appeals. Get a property tax abatement. Look up your property tax balance.

Active Duty Tax Credit. Get Real Estate Tax relief. And prompt collection of all revenue due to the City of Philadelphia and all tax revenue due to the School District of Philadelphia.

If more space is needed attach additional sheets. Get the Homestead Exemption. Look up your property tax balance.

Report a change to lot lines for your property taxes. Maintains the Philadelphia Register of Historic Places. Enroll in the Real Estate Tax deferral program.

Active Duty Tax Credit. Complete the correct certificate and submit it when you record the deed or mail in your Realty Transfer Tax. Get a property tax abatement.

Get Real Estate Tax relief. Beginning in tax year 2016 there is an exemption of the first 100000 in gross receipts and a proportionate share of net income from. This document amends Philadelphia tax regulations.

Active Duty Tax Credit. Get Real Estate Tax relief. Get Real Estate Tax relief.

Get a property tax abatement. If you have questions about appeals exemptions abatements and related issues you can contact OPA by using our online form or by calling 215 686-4334. Look up your property tax balance.

Active Duty Tax Credit. Look up your property tax balance. Enroll in the Real Estate Tax deferral program.

Active Duty Tax Credit. Get the Homestead Exemption. When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax.

Set up a Real Estate Tax installment plan. You can learn more from the. To check your tax compliance status and get a tax clearance certificate visit.

File a real estate market value appeal if. If you have questions about the tax year 2023 reassessment you can contact the OPA hotline at 215 686-9200. The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia.

Regulations rulings tax policy. Set up a Real Estate Tax installment plan. Employees who request a refund for travel should use our refunds date and location worksheet and must provide a copy of their Telework Agreement.

Realty Transfer Tax. The individualized survey link invitation will come from the phone number 1-855-270-3571. The Office of Property Assessment OPA decides the dollar-value of every piece of real estate within Philadelphia and that value determines how much property tax is owed.

Salaried employees can use these forms to apply for a refund on Wage Tax. Long-term leases 30 or more years Easements.

Philadelphia Passes Law To Close Transfer Tax Loopholes Paradigm Tax Group

On Transfer Taxes Philadelphia S Largest Real Estate Deals Fall Short

Pgn 1 09 09 Edition By The Philadelphia Gay News Issuu

Duane Morris Llp Offices Philadelphia

Philly S 10 Year Tax Abatement Philadelphia Home Collective

Philly Property Owners Get A Break City To Increase Homestead Exemption To 45 000

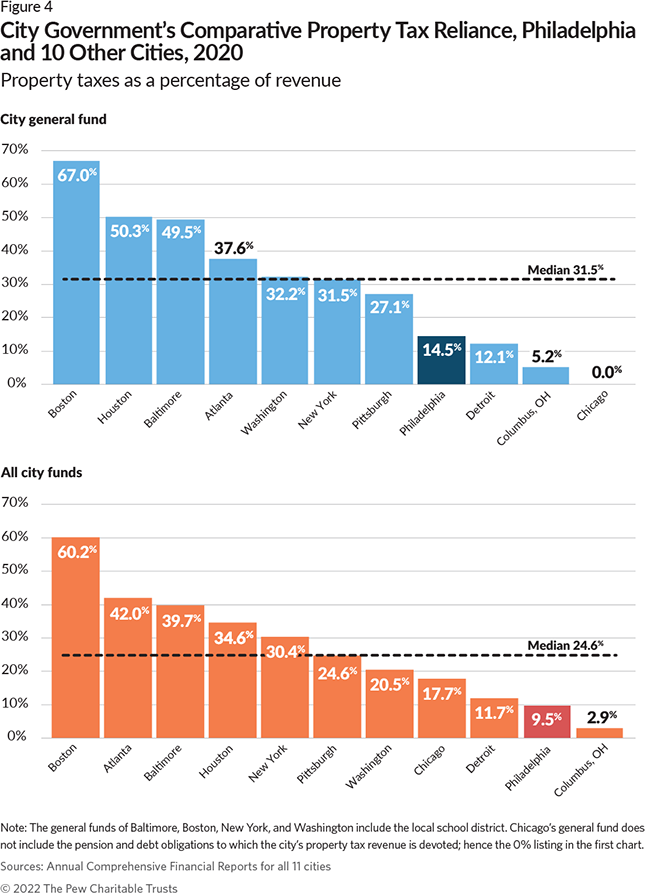

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Philadelphia Department Of Revenue Philadelphia Pa

Philadelphia Homeowners Apply For These Two Philadelphia Tax Exemption Programs This Weekend

Real Estate Transfer Taxes Deeds Com

44 Taxes We Pay As Residents Of The Great City Of Philadelphia Philadelphia Magazine

Worries Remain Regarding Philly Tax Income Whyy

840 Leland St Philadelphia Pa 19130 Mls Paph2154792 Redfin

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

Economy League Philadelphia Budget Analysis

2020 Award For Excellence Winner City Of Philadelphia

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia